A Professional Review of Your Existing Life Insurance

Importance of Life Insurance

Most Americans want to protect what’s important to them, their families, and their businesses. For many, life insurance is a tool they have used as a key component of a sound financial plan. That’s why we offer our complimentary Life Insurance Audit.

As your life changes and economic conditions change, it is important to verify that your plan is keeping up with your current needs and meeting your desired objectives.

Life Changes

Consider when you last reviewed your life insurance. Perhaps some of the following events occurred since then:

Has your family changed?

- Married, divorced, widowed

- Birth of children or grandchildren

- Responsibility for the care of a parent

Have you changed your lifestyle?

- Purchased a new home

- Changed employment

- Received an inheritance

- Started or sold a business

- Lost or hired a key employee

- College funding

- Retirement

Has your need for life insurance changed?

- Death benefit protection

- Supplemental retirement income

- Business planning

- Estate planning

- Charitable planning

Permanent life insurance is a complex financial strategy that should periodically be reviewed to gauge actual policy performance against original expectations. Changes in one or more of these areas may impact your planning goals – and your current insurance needs.

Economic Conditions

The economic conditions of the last few years have made it prudent to review all of your financial instruments. Low interest rates and a volatile equity market have negatively affected some portfolios. This has caused people to revisit and even rethink their investment strategies and goals.

- Low interest rates have created a rise in home mortgage refinancing

- Historically low fixed interest rates and equity market volatility have affected the underlying cash values in some permanent life insurance policies. (Cash value is often invested in instruments such as mortgages, bonds or stocks.)

The Life Insurance Industry

- The average lifespan has increased

- The cost of life insurance coverage has come down

- New, more efficient policies have been introduced to the marketplace as the market adjusts to a more competitive environment.

- Consumers have become more sophisticated and demand greater value – causing the marketplace to adjust

A Life Insurance Audit

Changes in your life, combined with economic conditions and changes impacting the life insurance industry, are reasons to review your current financial strategy. Together we will evaluate your present policies, analyze available options in policy funding and positioning in an effort to maximize the benefit of your life insurance coverage.

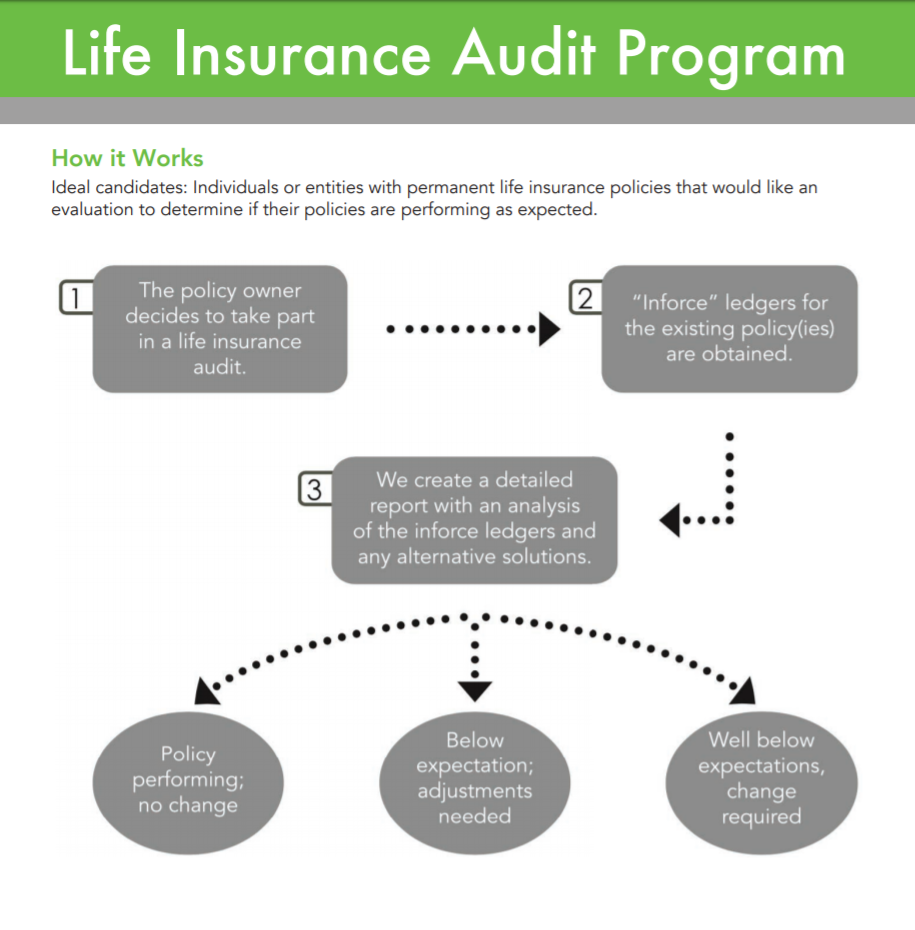

How It Works

Ideal candidates: Individuals or entities with life insurance policies that would like an evaluation to determine if their policies are performing as expected. Send me a message and we can get started right away on your Life Insurance Audit.